Additional Facts About the 2021 School Bond Referendum

Building for Success.

How Will Passage Affect the County's Bond Rating?

Of the nation’s more than 3,000 counties, Fairfax is among only 49 that have the highest credit rating possible for a local government from all three rating agencies:

- Aaa from Moody’s Investors Service.

- AAA from Standard & Poor’s.

- AAA rating from Fitch Investors Service.

Because of these ratings, Fairfax County’s bonds typically sell at exceptionally low interest rates.

The Fairfax County Board of Supervisors controls all county bond sales within financial guidelines drawn to ensure that the coveted triple-A bond ratings are not jeopardized.

How Are School Projects Selected?

Each year, the School Board and staff members work with the community to develop an updated five-year capital improvement program (CIP) for schools. To develop the CIP, the school system assesses changes in expected enrollments, academic programs, and facility conditions to determine priorities for new construction, renovations, and other capital facility projects. The School Board then evaluates the affordability of these school needs against other countywide requirements to determine the bond proposal.

Several factors were considered in determining which schools need to be addressed in the current CIP including:

- 2008 Renovation Queue Status.

- Overcrowding and/or growth experienced in the past several years.

- Continued use of temporary classrooms.

- Schools that serve Development Centers, which are areas where the majority of future development will be focused, as defined by the Fairfax County Comprehensive Plan.

Who Uses Our Schools?

Data presented in the following sections are from the School Year (SY) 2019-20 (pre-COVID closures).

Students and citizens use Fairfax County schools. Fairfax County Public Schools (FCPS) works with the Fairfax County Department of Neighborhood and Community Services and with the Fairfax County Park Authority to ensure that school facilities and athletic fields are available to the public after school hours.

The following are examples of how school buildings are used.

Students

During the school year, approximately 188,000 students use FCPS facilities daily for academic and extracurricular activities.

Community

Most of the public meeting places available in the county are FCPS facilities. In many cases, these facilities are provided free of charge to organizations such as homeowners associations, 4H, scouting groups, county employee organizations, and cultural and civic groups. In addition:

- Over 492,200 events occurred in school facilities.

- 168 schools and centers are used as polling places for general elections.

- 140 schools serve as sites for Fairfax County’s School Age Child Care (SACC) program.

- 110 religious and cultural organizations used FCPS facilities for regularly scheduled activities.

Neighborhood and Community Services

The Fairfax County Department of Community and Recreation Services is the largest “outside” user of FCPS facilities. The result is an outstanding recreation program at minimal cost to Fairfax County taxpayers. For example:

- During SY 2019-20, more than 320,000 individuals participated in recreation activities, with the vast majority using FCPS facilities.

- Community groups used 245 school gymnasium courts during the past year for recreational basketball, volleyball, and other indoor activities.

- 559 school athletic fields, representing 68 percent of all the fields available in the county, were used in last year’s recreation program.

- Eight schools were used as teen centers.

Park Authority

More than 27,000 citizens attended classes, camps, and Rec-PAC programs run by the Park Authority in FCPS facilities.

Adult and Community Education

Enrollment in FCPS Office of Adult and Community Education classes totaled nearly 26,000.

Why Add More Classrooms?

Since the 2011-12 school year, student membership has grown by an average of over 1,300 students each year for a total growth of more than 10,000 students. Due to these increases in student enrollment, more than 33 percent of schools are over capacity.

These trends of growth are inconsistent across the county and continue to present a facilities capacity challenge.

The CIP currently contemplates using bond proceeds to finance costs related to the planning and design of renovations at Bren Mar Park Elementary School (ES), Brookfield ES, Lees Corner ES, Armstrong ES, Willow Springs ES, Herndon ES, Dranesville ES, and Centreville High School (HS). The CIP further contemplates using bond proceeds to finance costs related to the construction of renovations at Wakefield Forest ES, Louise Archer ES, Crossfield ES, Mosaic ES (formerly Mosby Woods ES), Bonnie Brae ES, and Falls Church HS.

Why Renovate Our Schools?

The School Board is committed to protecting the community’s investment in schools and other buildings, which have a combined present value approaching $6.5 billion.

Not only do these facilities wear out over time, but they also become outdated, both technologically and instructionally. FCPS, therefore, renovates its schools to ensure that students, countywide, have effective and efficient learning environments.

Fairfax County public schools are expected to be usable for 20 to 25 years following completion of construction. Today, the FCPS renovation cycle is 37 years. The School Board is committed to reducing the school renovation cycle to 25 years or less. Renovations can extend the useful life of the school building another 20 to 25 years. A new or renovated school is 40-50% more efficient which supports Fairfax County School Board's phased goal for carbon neutral energy use by 2040. Renovations also help to relieve overcrowding by providing additional classrooms and spaces for required small group and specialized instruction. Schools are renovated in a sequence determined by published rankings of priority need. These priorities are established by independent professional assessments of each school’s physical condition.

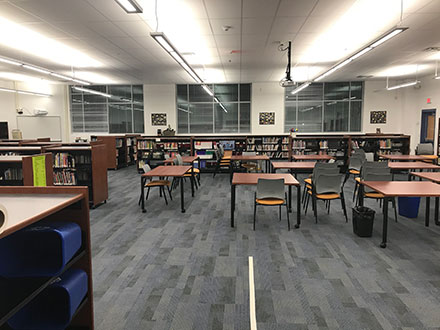

Examples of the other completed renovation improvements include: upgrading basic systems such as heating, air conditioning, lighting, and plumbing; remodeling libraries; upgrading science and technology laboratories; refurbishing general classrooms; upgrading wiring for multimedia devices; and providing upgraded furnishings and equipment.

Why Include Funding for Planning and Design?

The current CIP contemplates using bond funding to provide planning and design money for seven elementary schools and one high school renovation. Dedicating funds for project planning into one bond issue and actual construction money into a later bond issue allows timely implementation of the projects without committing the county’s bonding authority for construction costs earlier than necessary. Some projects need additional time for land acquisition, while other projects may require complicated construction designs and government approval procedures. With preplanning, such complicated projects can be completed earlier than they otherwise would have had planning and construction been authorized concurrently.

The current CIP contemplates using bond funding to provide planning and design money for seven elementary schools and one high school renovation. Dedicating funds for project planning into one bond issue and actual construction money into a later bond issue allows timely implementation of the projects without committing the county’s bonding authority for construction costs earlier than necessary. Some projects need additional time for land acquisition, while other projects may require complicated construction designs and government approval procedures. With preplanning, such complicated projects can be completed earlier than they otherwise would have had planning and construction been authorized concurrently.

Are There Other Requirements?

The cost of providing staff members to establish the projects' design criteria, manage the projects, and maintain quality control over contractor work on all projects funded by this bond proposal is included in the contractor's bonded costs. The estimated expense to underwrite and issue bonds is reflected in the bond referendum total as well.

How Will Passage Affect Your Tax Rate?

If approved, the bonds will be sold when needed to meet cash requirements for current and future CIP projects. To ensure that Fairfax County's coveted triple-A bond ratings are not jeopardized, the Board of Supervisors' financial guidelines provide that the annual cost of the county's debt service (principal and interest payments) be no greater than 10 percent of annual combined general fund disbursements.

The Board of Supervisors also maintains the county's net long-term debt at, or below, 3 percent of the total market value of taxable property in the county. If debt service costs do not increase significantly as a percentage of combined general fund disbursements, the county's bonded debt is not likely to be a contributing factor to any increase in local taxes.